How is Aotearoa doing on ESG reporting? Spoiler: She’s patchy out there.

Part 2

“Why you need to know (more) about ESG” blog series.

In our last post, we asked: what even is ESG, and why is it showing up everywhere?

This time, let’s zoom in on home turf. How is Aotearoa New Zealand actually tracking when it comes to ESG reporting? But before we go there, it helps to understand two things:

Why ESG reporting matters in the first place

What “standard practice” looks like — globally and here in NZ

Why ESG reporting matters in the first place

At its simplest, ESG reporting is about transparency. It’s how organisations show the impact of their decisions on people, planet, and prosperity (or profit).

For investors: it reduces risk and signals long-term resilience.

For people and communities: it builds trust and credibility.

For the organisation itself: it helps track progress and spot blind spots (such as unintended consequences on the three p’s - also known as Triple Bottom Line 👈 and yes, I know it’s a wiki-link but that’s just to give you a quick intro, so shhh).

In short: reporting isn’t just a compliance exercise (it sure as heck shouldn’t be, anyway). Done well, it’s a powerful decision-making tool that encourages ethical practices.

What “standard practice” looks like — globally and here in NZ

There are international frameworks that guide ESG reporting — and while many have an environmental focus, most also cover social and governance dimensions:

GRI (Global Reporting Initiative) – still the most widely used standard globally, and one of the few that goes deep into social (e.g. human rights, labour practices, community impact) and governance disclosures alongside environmental topics.

ISSB (International Sustainability Standards Board) – launched in 2023 to set a global baseline for sustainability disclosure. Its first two standards (IFRS S1 & S2) start with climate, but ISSB has flagged that human capital and biodiversity/nature are next in line.

TCFD (Task Force on Climate-related Financial Disclosures) – while it’s climate-only, it has shaped thinking about how to disclose risk in a structured, comparable way (now expanded in ISSB). Additionally, currently in development are principles being developed by, wait for it, the TISFD (The Taskforce on Inequality and Social-related Financial Disclosures). Woooo!

SDGs (Sustainable Development Goals) – often used as a framing tool, particularly for social impact alignment (think equity, decent work, reduced inequalities).G

In New Zealand, mandatory climate disclosures (based on TCFD) came into force in 2023 for listed companies, large banks, insurers, and investment managers. Beyond that, most ESG reporting here is voluntary — which has impact on consistent practice 🙄😨😬

So how is Aotearoa, New Zealand doing?

Well, you saw our spoiler in the title. It’s patchy!

The good part. Someone’s gotta be first!

27 October, 2021: New Zealand was a global pioneer by being the first country to legislate mandatory climate-related financial disclosures when Parliament passed Financial Sector (Climate-related Disclosures and Other Matters) Amendment Act 2021.

December, 2022: The External Reporting Board (A.K.A XRB) then released the official Aotearoa NZ Climate Standards. These standards set out ‘the how’ of ‘the what’ (the aforementioned Act).

From 1 January 2023: Nearly 200 Climate Reporting Entities (e.g. listed businesses, banks, insurers, and investment managers) have been required to publish climate statements aligned with those standards.

From late 2024: The auditors need to be brough in with assurance over GHG emissions mandatory for reporting periods ending on or after 27 October, 2024.

The other parts where things get… murkier.

While Aotearoa leads the world in legislating climate disclosures, the rest of our ESG reporting story is less inspiring.

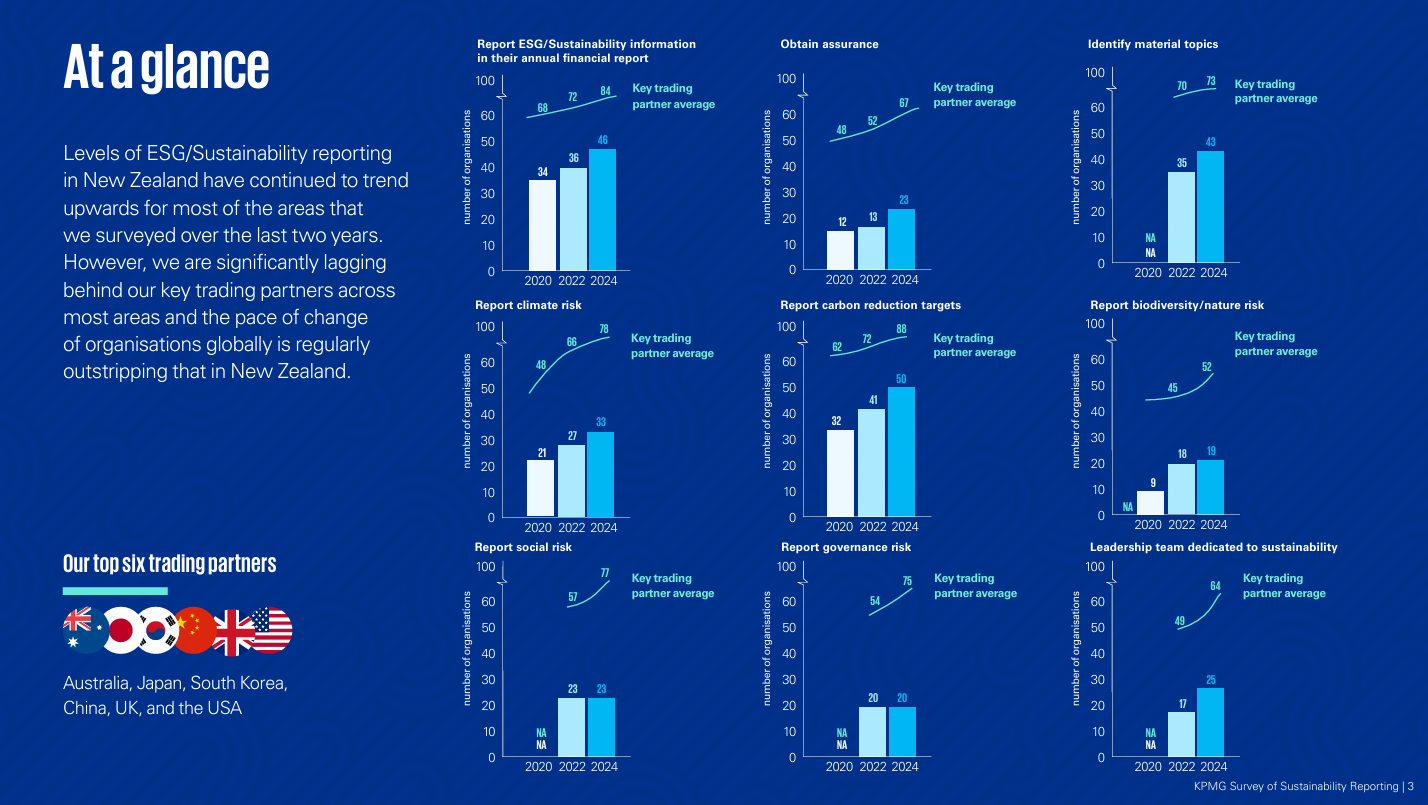

According to KPMG’s 2025 Survey of Sustainability Reporting (NZ supplement), reporting levels are trending upwards — but at a slower pace than our global peers. Across almost every measure, New Zealand is well behind our key trading partners (Australia, Japan, South Korea, China, UK, and the USA).

Some of the sting-iest gaps are:

Independent assurance: Only 23 of New Zealand’s top 100 organisations obtained independent assurance in 2024, compared with an average of 67 out of 100 among our key trading partners

Social and governance reporting: Progress has stalled, with just 23 of New Zealand’s top 100 organisations reporting social risks, and only 20 reporting governance risks — the same numbers as in 2022. By comparison, among our key trading partners an average of 57 report on social risks and 75 on governance

Nature and biodiversity: only 19 organisations report on these risks, a big gap for a country whose economy relies heavily on land, water, and nature.

Leadership: just 25 organisations have a dedicated sustainability leadership team, compared with 64 overseas.

The trend is clear: we are improving, but whoar it’s a slow hard slog. And while we celebrate world-first moves on some aspects of the “E”, the “S” and “G” pillars remain underdeveloped. In other words, Aotearoa’s ESG reporting is patchy, and the gap with our trading partners is widening.

So where does all of that👆 leave us? Well, it’s progress worth noting, but also some bloody big gaps to close if we want ESG focuses to

🫂drive fairer outcomes for people, and

💪stronger more resilient economies, and

❤️🩹healthier communities.

Part 3 coming up next:

The social side of ESG (and it’s not small talk)

Want help making ESG meaningful within your organisation?

At Impact Ink, we help organisations:

Map what matters (social and governance expertise with environmental partners at the ready)

Build ESG-aligned strategy and stories

Translate values into action — and action into evidence.

We keep it grounded, plain language, and tailored to where you're at.

👋 Let’s kōrero.

#ESG #SustainabilityReporting #AotearoaBusiness #NewZealandBusiness #ImpactInk